Which Of The Following Best Explains Why Raising The Discount Rate Affects The Money Supply

Which of the following best explains why raising the discount rate affects the money supply. A An increase in the money supply. This policy reduces the money supply slows lending and therefore slows economic growth. Answer choices When the discount rate is high banks have less incentive to give loans because they make less profit on these loans.

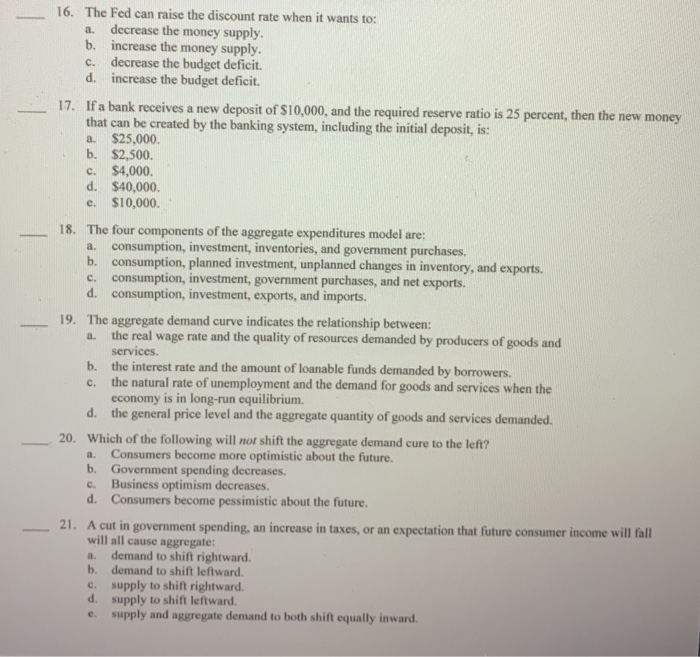

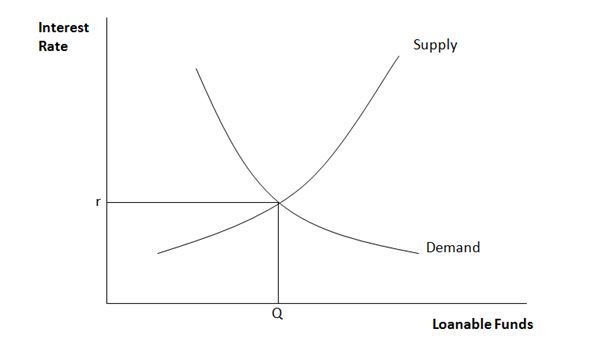

The money market is an economic model describing the supply and demand for money in a nation. If the discount rate is raised too high it could throw this coordinating mechanism out of balance. The discount rate is the interest rate on secured overnight borrowing by depository institutions usually for reserve adjustment purposes.

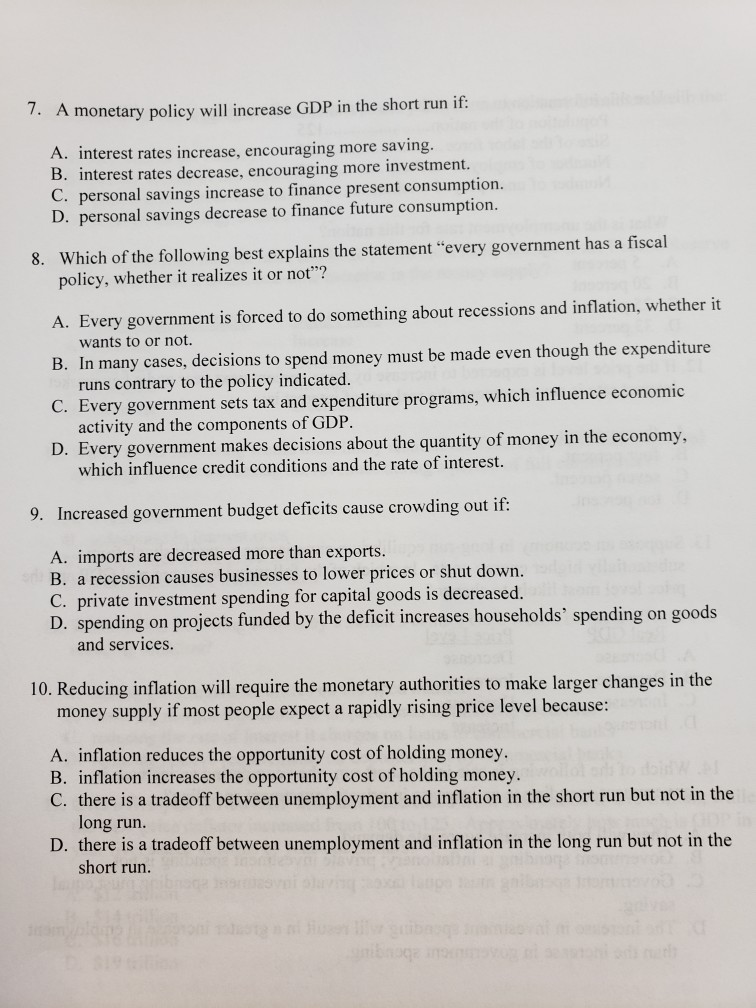

The Federal Reserve the Fed can affect the money supply by using the discount rate because it will affect the amount of lending that goes on in the economy. A decrease in the discount rate makes it cheaper for commercial banks to borrow money which results in an increase in available credit and lending activity throughout the. Which of the following statements BEST describes why an increase in the discount rate often results in a decrease in the money supply.

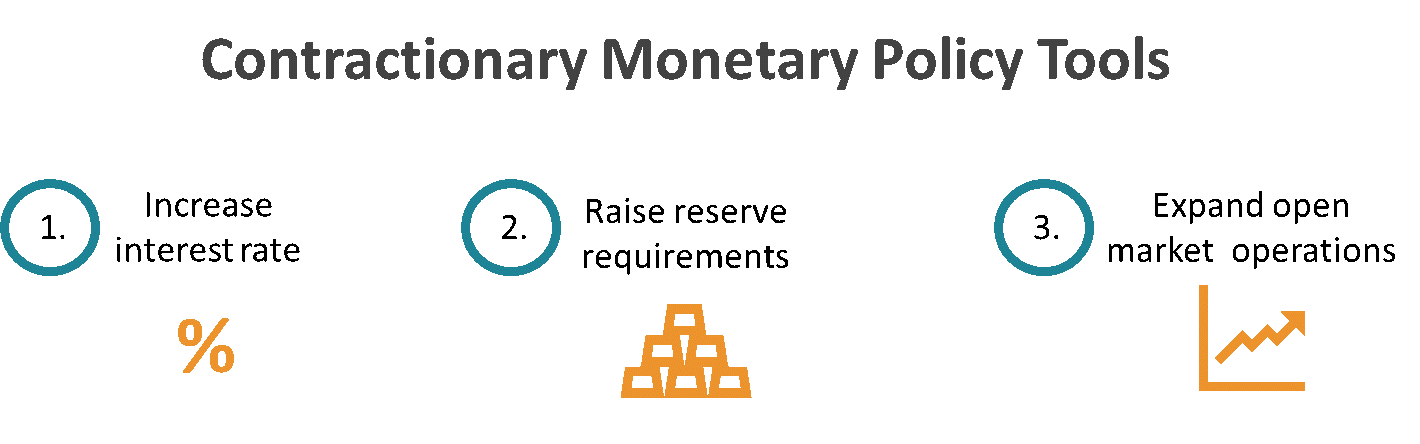

When the discount rate is high banks are able to charge lower interest rates so that more people can afford to take loans. More immediate impacts are felt from a high discount rate. The Fed raises the discount rate when it wants all interest rates to riseknown as contractionary monetary policy it is used by the central banks to fight inflation.

Increasing the discount rate to discourage banks from extending high risk loans. Which of the following best explains why raising the discount rate affects the money supply. It is assumed the bank cant get loans from other banks and thats why the Federal Reserve is also known as the bank of last resort.

January 19 2021 In the United States the Federal Reserve may increase the money supply. Purchasing government securities to increase the money supply and therefore lower the interest rates. In times of recession The FED uses expansionary policies such as increasing the money supply by buying bonds lowering the discount rate and lowering reserve requirementsIn times of over.

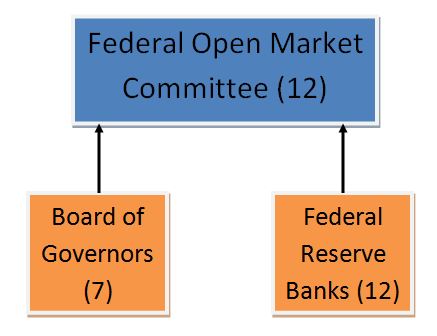

The interest rate falls from r1 to r2 and output rises from Y to Y2. Discount rate changes also are subject to review by the Board of Governors of the Federal Reserve System.

The Federal Reserve the Fed can affect the money supply by using the discount rate because it will affect the amount of lending that goes on in the economy.

Adecrease in the discount rate and an increase in the interest rate on reserves both increase the money supply. Asked Jun 16 2016 in Business by Alaska A An increase in the discount rate will lower the overall values of loans from the Federal Reserve Banks to individual banks. The increase in output occurs because the lower. Discount rate changes also are subject to review by the Board of Governors of the Federal Reserve System. Which of the following best explains why raising the discount rate affects the money supply. Answer choices When the discount rate is high banks have less incentive to give loans because they make less profit on these loans. An increase in money supply causes interest rates to drop and makes more money. Consumers and businesses have a demand for money including cash and checking and savings accounts. Which of the following is an expansionary monetary policy Reducing the Federal Reserve discount rate Selling government bonds by the fed.

Which of the following is an expansionary monetary policy Reducing the Federal Reserve discount rate Selling government bonds by the fed. The discount rate is the interest rate on secured overnight borrowing by depository institutions usually for reserve adjustment purposes. Which of the following best explains why raising the discount rate affects the money supply. Most banks avoid using the discount window because there is a stigma attached. In the United States the circulation of money is managed by the Federal Reserve Bank. Consumers and businesses have a demand for money including cash and checking and savings accounts. Increasing the discount rate to discourage banks from extending high risk loans.

/expansionary-monetary-policy-definition-purpose-tools-cb588175cf0342b1b5e3cd4aad67bbc4.png)

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)

/what-is-monetary-policy-objectives-types-and-tools-3305867-v4-5b6888c846e0fb002546b942.png)

/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Multiplier_Effect_Sep_2020-01-b2d70a7907ae427c92e2b0a1f669eacc.jpg)

Posting Komentar untuk "Which Of The Following Best Explains Why Raising The Discount Rate Affects The Money Supply"